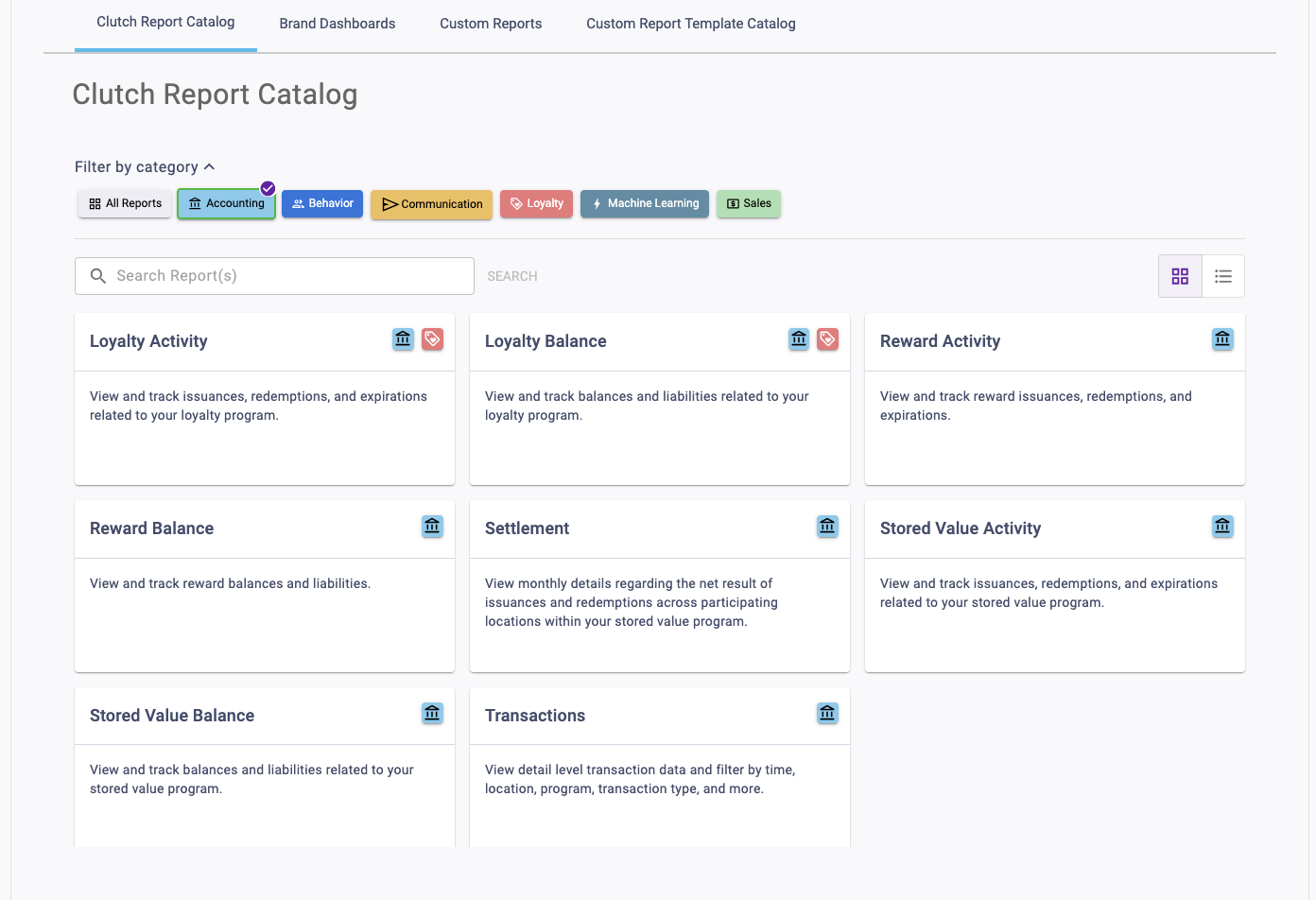

Within the Clutch Reporting Catalog, you can find several Accounting Reports. These Accounting Reports include:

- Loyalty Activity

- Loyalty Balance

- Reward Activity

- Reward Balance

- Stored Value Activity

- Stored Value Balance

- Settlement

- Transactions

You may not see all the reports listed above. Reports will only populate if your brand utilizes the corresponding balance types for each report. For example, if your brand does not have a loyalty program, you won’t see any reports related to loyalty, such as the Loyalty Activity or Loyalty Balance Reports.While in the Clutch Report Catalog, you can click the Accounting chip to filter the reports so only these reports appear.

Some of these reports may have unique elements to them, such as specific metrics. We’ll break down some definitions, export types, and more for each report type below.

Activity reports allow you to track issuances, redemptions, and expirations. Activity Reports include the Loyalty Activity, Reward Activity, and Stored Value Activity Reports.

Definitions

Issued Amount: The amount of the balance type that was issued.

Redeemed Amount: The amount of the balance type that was redeemed.

Expired Amount: The amount of the balance type that was expired.

Void Issued Amount: The amount of the balance type that was issued as part of a void.

Void Redeemed Amount: The amount of the balance type that was redeemed as part of a void.

Cashout Amount: The balance amount that was redeemed as part of a cashout. This only applies to the Stored Value Report.

Issuances: The count of times a balance was issued.

Redemptions: The count of times a balance was redeemed.

Expirations: The count of times a balance expired.

Void Issuances: The count of times a balance was issued as part of a void.

Void Redemptions: The count of times a balance was redeemed as part of a void.

Mutation Types

Mutation types that may be available within Activity Reports include:

- Unknown

- Update Balance

- Hold

- Adjustment

- Campaign

- Transfer

- Void

- Return

- Expiration

- Cash Out

- Void Cash Out

Exports for Activity Reports

Detail Export

This export provides a card-level detail of all of the cards that had activity matching the filter criteria. The export is not available in report Views that show multiple balance types (ex: Reward Type or Currency) because it can only be run for one balance type at a time.

Balance Reports allow you to track balances and liabilities. Balance Reports include Loyalty Balance, Reward Balance, and Stored Value Balance Reports.

Definitions

Segment: This column will only populate if your brand has used Segment Import to tag and split out a balance for a segment of cards.

Balance: The amount of the balance type that is active.

Expired Balance: The amount of the balance type that is expired.

Exports for Balance Reports

Detail Export

This export provides a card-level detail of all of the cards that have balances matching the filter criteria. The export is not available in report Views that show multiple balance types (ex: Reward Type or Currency) because it can only be run for one balance type at a time. If you are within the Holds View, the detail export in this view provides a card-level detail of all of the cards with held balances matching the filter criteria.

Aging Export

This export will provide an Excel file with a burndown of all balances that match the filter criteria. The file is broken out vertically by issuing month and horizontally by each activity month since the issuing month. The export is not available in report Views that show multiple balance types (ex: Reward Type, Currency, or Holds) because it can only be run for one balance type at a time.

The Settlement Report allows you to view monthly details regarding the net result of issuances and redemptions across participating locations within your stored value program. This report only applies to Stored Value brands configured for settlement across participating locations within their program.

Definitions for Summary View

Credits: The amount credited towards this location for the settlement run.

Debits: The amount debited from this location for the settlement run.

Net Total: The net amount credited and debited for this location for the settlement run.

Definitions for Conversions View

Credit: The amount in the Currency Type credited towards this location for the settlement run.

Debits: The amount in the Currency Type debited from this location for the settlement run.

Conversion Rate: The conversion rate used to convert the Currency Type amount in Credits and Debits to USD.

Converted Credits: The amount in USD credited toward this location for the settlement run.

Converted Debits: The amount in USD debited from this location for the settlement run.

Net Total: The net amount in USD that has been credited and debited for this location for the settlement run.

Export the Settlement Report

Detail Export

This export provides a card-level detail of all the cards included in the settlement run.

The Transaction Report allows you to view detail-level transaction data and filter by time, location, program, transaction type, and more. The total transaction count will match the filter criteria.

The report table only returns a maximum of 500 randomized records that match your filter criteria. The Infobox provides a reference point of how many total records would be included in the Detail Export.

Export the Transaction Report

Detail Export

This export provides a detailed breakout of all transactions that match the filter criteria.

Note that all of the dates within new Clutch reporting are specific to the brand’s reporting time zone that is configured in their brand settings.

- Start Dates begin as of 12:00:00AM of the chosen date

- End Dates end as of 11:59:59PM of the chosen date

Please note that with Clutch’s Legacy Reports, the old Clutch reports passed end dates as of 12:00:00AM of the day after the chosen date.

This change was made because the old logic included 1 second of the following day, it would capture any activity that happened within that second. The End Date time stamp has been moved forward 1 second to ensure that we are not capturing any activity of the following date.